Inflation Rates Comparison: A Comprehensive Overview

Inflation is a critical indicator of economic health, affecting everything from the cost of groceries to mortgage interest rates. Understanding it requires a multidimensional analysis beyond the generic consumer price index (CPI) figures. This blog post dives deep into the nuances of inflation by exploring different factors influencing rate variations globally and comparing trends across countries to provide a more holistic view. We also take a brief look into promoted content to offer tips for managing personal finances in inflationary times. Lastly, we invite readers to share their thoughts and experiences with inflation in the comments section. By learning these lessons, readers will be empowered to navigate through inflationary pressures effectively and make informed economic decisions.

The Consumer Price Index only tells part of the story.

The Consumer Price Index (CPI) is often the go-to metric for assessing inflation rates, but it only provides a linear perspective. The CPI measures the average change in prices over time that consumers pay for a fixed basket of goods and services. However, goods and services vary widely between economies, and it fails to capture essential data like regional cost variances and changes in consumer behavior over time. Inflation can also be driven by supply chain issues that do not typically factor into CPI measurements.

To get a more accurate picture, one must consider the Producer Price Index (PPI) and wage inflation statistics. The PPI indicates the price changes from the perspective of the seller, and wage inflation gives insight into how income changes counterbalance consumer price fluctuations. Together, these indices can help policymakers and economists craft more robust economic strategies targeting inflation more comprehensively.

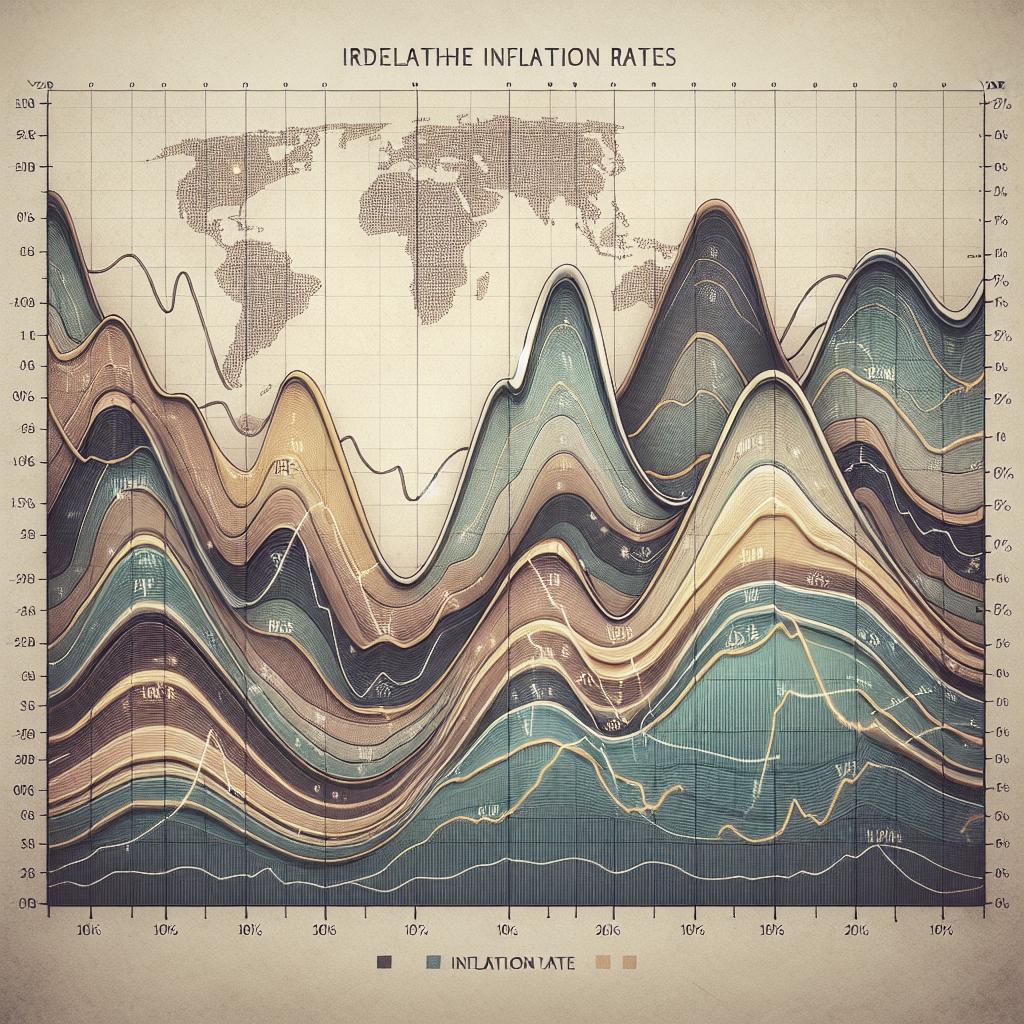

Inflation Rate: A Global Comparison

Globally, inflation rates show considerable disparity due to varied economic structures, labor markets, and government interventions. Countries like Venezuela and Zimbabwe are infamous for hyperinflations caused by political instability and fiscal mismanagement. In contrast, developed nations such as the USA, Germany, and Japan generally experience more stable inflation rates owing to strong economic frameworks and effective monetary policies.

The European Central Bank and the US Federal Reserve have utilized interest rates and other monetary policy tools to keep inflation in check. Meanwhile, emerging economies often face challenges related to external debt, commodity dependency, and inflation-targeting policies. Understanding these differences can provide valuable insights into the diverse impacts of inflation and the tailored mechanisms needed to address them across continents.

Promoted Content

Dealing with inflation requires more than textbook economic theory; practical strategies can help individuals and businesses alike manage the impact. Many financial advisors recommend diversifying investment portfolios with commodities like gold, which typically increase in value during inflationary periods. Another approach is to focus on assets like real estate and stocks that can offer returns exceeding inflation rates.

For consumers, maintaining a budget and regularly reviewing spending habits will provide better control over finances in an inflationary environment. It’s also beneficial to explore bargains and discounts, opting for alternatives to expensive goods and services without severely compromising the quality of life. These personalized techniques can help mitigate the everyday challenges posed by rising prices.

Comments

We’d love to hear your opinions and experiences. What are your thoughts on the current global inflation trends? How are you personally dealing with inflation? Feel free to share your comments below and engage in the discussion with our community.

| Topics | Key Insights |

|---|---|

| Consumer Price Index | Limited in scope; doesn’t fully encompass price changes or regional variance. |

| Global Inflation Comparison | Wide differences remain due to economic and political frameworks; some nations face hyperinflation, while others maintain stability. |

| Promoted Content | Practical financial strategies include diversifying investments in commodities and real estate, and maintaining an adaptable budget. |